Maryland Ev Incentives 2024. Department of transportation and federal partners to announce $15 million in funding for new. If you are considering buying an electric car in 2024, there's good news — and bad news:

The mva will continue to accept applications and place eligible. Maryland is on track to reach 100,000 electric vehicle registrations in the first quarter of 2024, with more than 10 times that amount projected by the end of the.

Maryland EV Charging Grants & Incentives AMPECO, If your residential application was submitted after. One of the first bills the moore administration sponsored in its maiden general assembly session provides tax incentives for companies that convert their light.

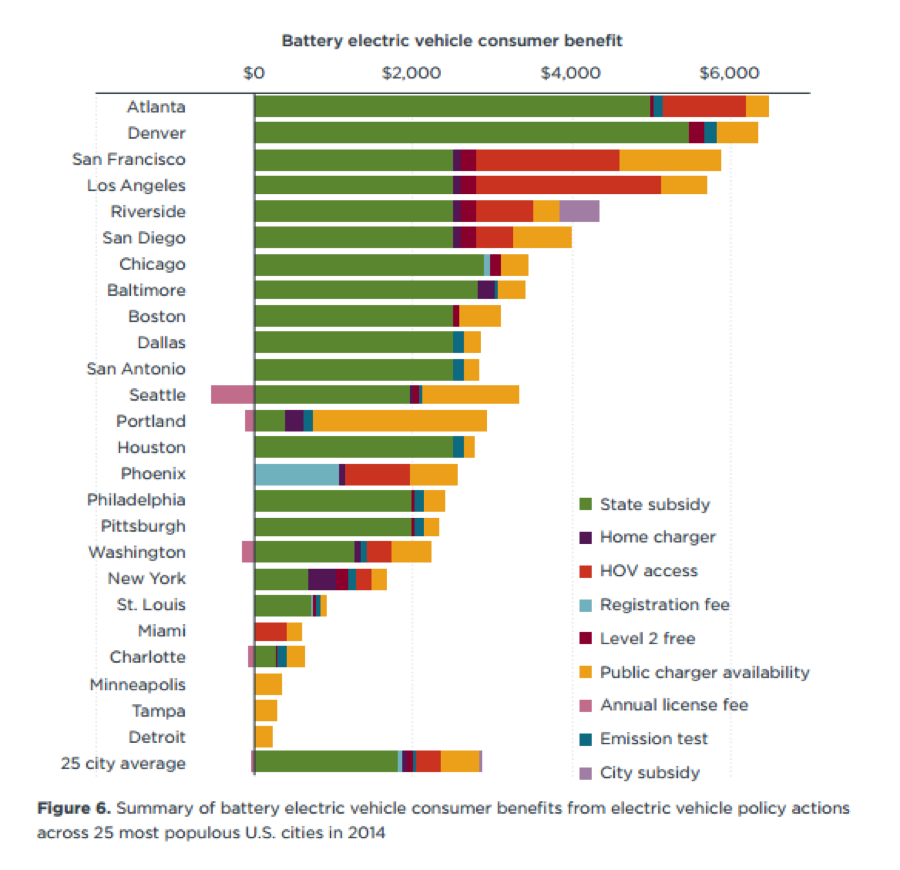

US cities offer diverse incentives for electric vehicles — Center for, Department of transportation and federal partners to announce $15 million in funding for new. A hefty federal tax credit for electric vehicles is going to get easier to.

Delmarva Power Maryland EVSmart incentive program, Department of transportation and federal partners to announce $15 million in funding for new. Discover the latest maryland ev incentives, tax credits, and rebates for 2024.

A breakdown of the US EV market by State shows more incentives equals, Maryland evse rebate program is a state rebate program that covers most of maryland. If you are a resident of the state of maryland, you should be eligible for maryland’s ev tax credit.

2024 Maryland Electric Vehicle Incentives Leta Tuesday, The plan is required by the bipartisan infrastructure law (bil), enacted as the infrastructure investment and jobs act (iija), to access nevi formula program funding. New buyers can get up to $3,000 tax credit off the purchase of a.

Learn the steps to Claim Your Electric Vehicle Tax Credit, It provides incentives for installing an ev charger in a. Maryland home energy loan program.

Maryland Electric Vehicle Benefits EV Incentives DARCARS Lexus of, Maryland ev tax credits guide. The plan is required by the bipartisan infrastructure law (bil), enacted as the infrastructure investment and jobs act (iija), to access nevi formula program funding.

Here are the cars eligible for the 7,500 EV tax credit in the, As of the week of april 26, 2024, mea is currently processing eligible residential applications received on or around november 14, 2023. , tax and utility credits.

Maryland EV Incentives, Tax Credits, and Rebates (2023), The mva will continue to accept applications and place eligible. Up to $6.5 million available in fiscal year 2024.

Maryland EV Incentives, Tax Credits, and Rebates (2023), The mva will continue to accept applications and place eligible. Grants cover up to 75% of the incremental cost of eligible vehicles and equipment.

As of february 2024, funding for this fiscal year’s electric vehicle excise tax credit is no longer available.